- Introduction: Briefly introduce gold as a precious metal and its significance, highlighting that its price fluctuates daily.

- What is Gold Rate Today?: Explain that “gold rate today” refers to the current market price of gold, which is influenced by numerous global and local factors.

- Global Economic Factors: Discuss how global economic indicators like inflation, interest rates, and GDP growth in major economies (US, China, Europe) impact gold prices.

- Geopolitical Events: Explain the role of geopolitical tensions, conflicts, and political instability in driving investors towards gold as a safe-haven asset.

- Supply and Demand Dynamics: Detail how the supply from mining and recycling, coupled with demand from jewelry, industrial use, and investment, affects the price.

- Currency Fluctuations: Specifically address the inverse relationship between the US Dollar and gold prices, as gold is typically denominated in USD.

- Central Bank Policies and Gold Reserves: Discuss how central banks’ decisions regarding interest rates and their accumulation or selling of gold reserves influence the market.

- Investment Demand (ETFs, Futures, Bullion): Elaborate on different investment avenues for gold and how investor sentiment and flows into these instruments impact the rate.

- Local Market Factors (Specific to a region/country, e.g., India/Pakistan): Briefly touch upon local taxes, import duties, and festivals that can create specific demand patterns in certain regions. (Since the user’s location is Haroonabad, Pakistan, I can hint at this without needing to specify a country unless asked).

- Conclusion & Outlook: Summarize the dynamic nature of gold prices, reiterate its role as a key economic indicator and investment, and advise checking real-time sources for the most accurate current rate.

Given that I need to provide factual context about gold rates without giving a specific daily rate (which would be outdated immediately), I should search for general information on factors affecting gold prices and how they are determined.

Here are the search queries I will use:

- What factors influence the daily gold rate?

- How do global economic indicators affect gold prices?

- What is the role of geopolitical events in gold price fluctuations?

- How does supply and demand impact gold prices?

- What is the relationship between the US dollar and gold prices?

- How do central bank policies influence gold rates?

- What are the main types of gold investment demand?

- How are local gold rates determined in different countries?

I will then synthesize this information into a 10-paragraph article.

Gold Rate Today: Understanding the Dynamics of a Precious Metal

Gold, a timeless symbol of wealth and stability, has captivated humanity for millennia. From ancient civilizations to modern financial markets, its allure remains undiminished. While often perceived as a fixed asset, the “gold rate today” is, in reality, a constantly fluctuating figure, influenced by a complex interplay of global economic forces, geopolitical shifts, and fundamental market dynamics. Understanding these underlying factors is crucial for anyone interested in this precious metal, be it for investment, adornment, or as an economic indicator.

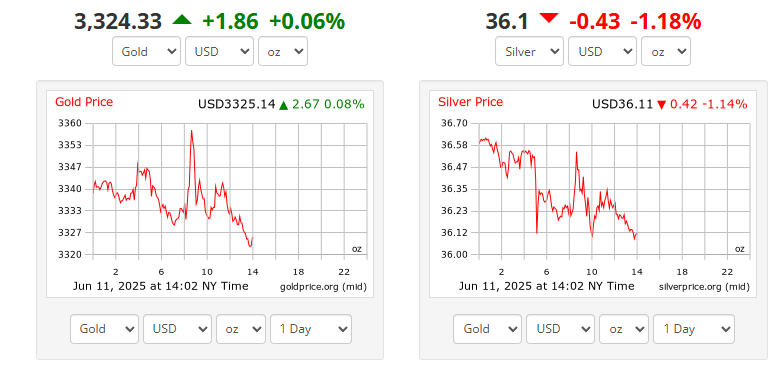

The daily gold rate is a snapshot of its current market price, reflecting the aggregate sentiment and activity of traders, investors, central banks, and consumers worldwide. Unlike industrial commodities whose prices are primarily driven by manufacturing demand, gold’s value is heavily influenced by its role as a safe-haven asset and a store of value. This intrinsic characteristic makes its price highly sensitive to shifts in the global landscape, often moving inversely to traditional financial instruments like stocks and bonds during times of uncertainty.

Global economic factors play a pivotal role in shaping gold’s price. During periods of high inflation, for instance, gold often shines as investors seek to preserve their purchasing power against eroding fiat currencies. Conversely, when real interest rates (nominal interest rates minus inflation) rise, the opportunity cost of holding non-yielding gold increases, making interest-bearing assets more attractive and potentially dampening gold demand. Similarly, strong economic growth in major economies might divert investment away from gold towards more growth-oriented assets, while recessions or economic instability can bolster its appeal.

Geopolitical events are another potent catalyst for gold price fluctuations. Conflicts, political instability, trade wars, or even diplomatic tensions can heighten uncertainty in global markets, prompting investors to flock to gold as a traditional safe haven. The immediate aftermath of such events often sees sharp spikes in gold prices as risk aversion intensifies. While these gains can sometimes be temporary, prolonged periods of geopolitical unease tend to provide sustained support for gold’s valuation.

The fundamental principles of supply and demand also exert significant influence. Gold’s supply primarily comes from new mine production and recycled gold. While mine output is relatively stable, recycled gold can fluctuate with economic conditions and price levels, as higher prices incentivize more recycling. On the demand side, major drivers include jewelry consumption (especially in countries like India and China), industrial applications (electronics, dentistry), and investment demand through various instruments like bars, coins, and exchange-traded funds (ETFs). An imbalance, where demand outstrips supply, typically leads to higher prices, and vice-versa.

Currency fluctuations, particularly the strength of the US Dollar, have a profound inverse relationship with gold prices. Since gold is universally priced in US Dollars, a stronger dollar makes gold more expensive for holders of other currencies, potentially reducing demand and leading to a price decline. Conversely, a weaker dollar makes gold cheaper for international buyers, stimulating demand and often pushing prices higher. This dynamic is a key consideration for global investors and contributes to gold’s daily volatility.

Central bank policies are increasingly influential in the gold market. Central banks around the world strategically manage their gold reserves as a hedge against currency devaluation and economic instability. Large-scale buying or selling by central banks can directly impact market supply and demand. Furthermore, their monetary policy decisions, particularly on interest rates and quantitative easing, create ripple effects. Lower interest rates generally make gold more attractive, while higher rates can diminish its appeal.

Investment demand forms a crucial component of the gold market. Beyond physical bullion, investors access gold through various financial instruments. Gold-backed Exchange-Traded Funds (ETFs) allow investors to gain exposure to gold prices without holding the physical metal. Futures and options contracts provide avenues for speculative trading and hedging. The collective sentiment and capital flows into these investment vehicles significantly contribute to short-term price movements and long-term trends.

Local market factors also play a role in determining the final price consumers pay in different countries. While the international spot price sets the benchmark, local gold rates are further influenced by import duties, taxes (like GST), local supply-demand imbalances, and cultural factors. For instance, in regions with strong cultural traditions of gold gifting, festive seasons often see a surge in demand, which can lead to local premiums over international prices. These regional nuances highlight the intricate web of factors at play.

In conclusion, the “gold rate today” is far from a static number; it is a live reflection of intricate global economic, political, and market forces. Its appeal as a safe-haven asset, an inflation hedge, and a store of value ensures its continued relevance in the financial world. For both seasoned investors and curious observers, monitoring the interplay of these diverse factors provides valuable insights into not just the price of gold, but also the broader health and sentiment of the global economy. For the most accurate and real-time gold rates, consulting reputable financial news sources and commodity exchanges remains the best practice.